Black square tin suitable for packaging gifts or wedding favors

Since its establishment, Tsing has been committed to customizing iron box packaging for various wedding events and holidays. Recently, personalized and unique wedding gifts have become popular in countries such as Europe and America, and black square tin has become an ideal packaging solution for these gifts. Below, we’ll tell you what features Tsing’s black square tins have to make them the perfect choice for packaging wedding gifts.

The elegance and sophistication of the black square tin

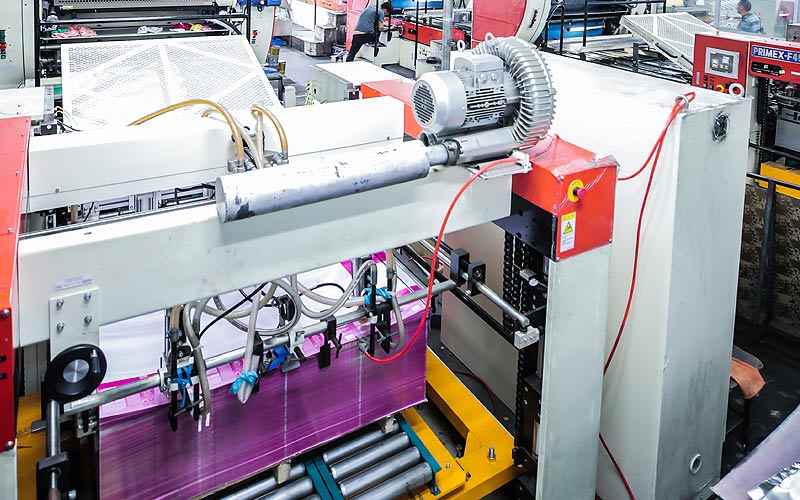

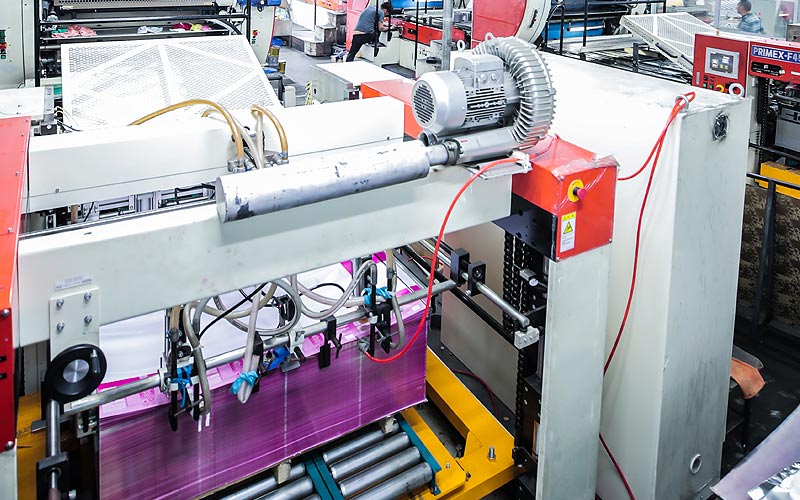

The core of Tsing’s black square tins’ elegance and sophistication lies in its cutting-edge printing technology, enabling more details in the design. We can give more complex printing effects through the most advanced metal printing, such as bright silver, UV + matte, wood grain effect, etc. Whether you want to hold candies, chocolates, or other small gifts, black square tins can be customized according to specific item attributes to enhance the display effect of wedding gifts.

The versatile design of the black square tin

Black square tins are different from traditional gift packaging options. The black attribute can provide couples with a blank canvas. You can engrave the surface of the tin to create personally desired patterns. Couples can add their names, weddings, etc., to each tin. Date. These black square jars efficiently use shelf space, maximizing storage capacity and improving product visibility. Whether displayed on retail shelves or stacked in a storage facility, they won’t take up much of your space.

Black square tin for durability and protection

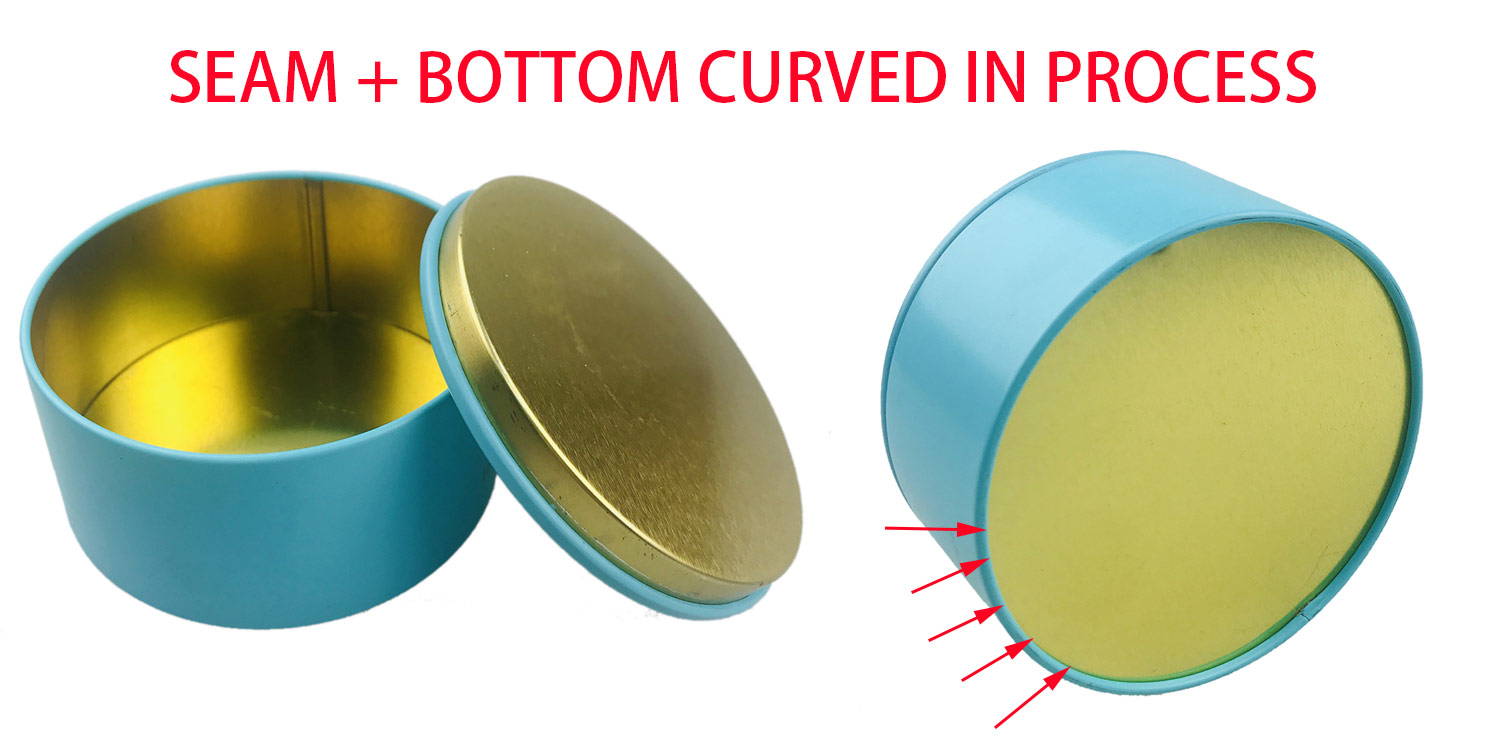

Tsing’s black square tins are durable because we use high-quality tin plates that are not easily bent by hand. We built it to withstand the bumps of handling and shipping, so it has a sturdy barrier that protects items inside from damage. In addition, tinplate’s anti-rust and oxidation protection ensures stored products’ long-term integrity and freshness. In addition to sturdy construction, we use sealing technology on the lids of our black square cans to provide optimal protection against light and moisture, forming a protective barrier.

Customizable options

In a customized way, you can add your personal name, date, or blessing message to the black square jar. Whether it is a wedding, birthday, or corporate event, the personalized black square jar is a unique and meaningful souvenir for the recipient. Leave a lasting impression on people. You can apply custom colors, patterns, and finishes to the black square tins, allowing unlimited creativity with specific themes or design concepts. For its functionality, you can choose various ways to open the lid, such as sliding, hinged, etc.

Tips for wedding gifts

If you decide to use a black square tin as a wedding gift, its overall size and shape should not be too large or long. As a gift box, the most important thing is that it is exquisite. Our recommended size is 50cm x 50cm, with extra space left for decorations if required. Finally, add a more personal touch to your thoughtful gift by including a handwritten note in a black square tin and an elegant gift box, basket, or ribbon.

Ultimately

Black square tins are the perfect packaging solution for couples looking to elevate their wedding and create a memorable guest experience. It offers endless possibilities in elegance, versatility, durability, and customizability. This ensures your guests leave with a lasting memory of the love and joy they received on their special day.

Facebook

Facebook Twitter

Twitter Linkedin

Linkedin